The Latest

-

Q&A

Pushpay targets church payment niche

The company caters to churches and other nonprofits, smoothing the channels to take in donations in various forms, including cryptocurrencies.

-

Maryland passes EWA law

The state’s governor allowed an earned wage access bill to become law, over the objections of some consumer groups, including AARP.

-

Remittance tax draws fintech pushback

The budget bill proposal moving through Congress would levy a tax on cross-border money transfers. That has prompted “strong concern” from one fintech organization.

-

PayPal’s venture arm taps new leader

The digital payments company has promoted Ian Cox Moya, who rejoined the company in 2022, to head the unit that invests in startups.

-

Global Payments to sell payroll unit for $1.1B

The payments processor agreed to sell the division to software company Acrisure as it focuses on selling merchant services.

-

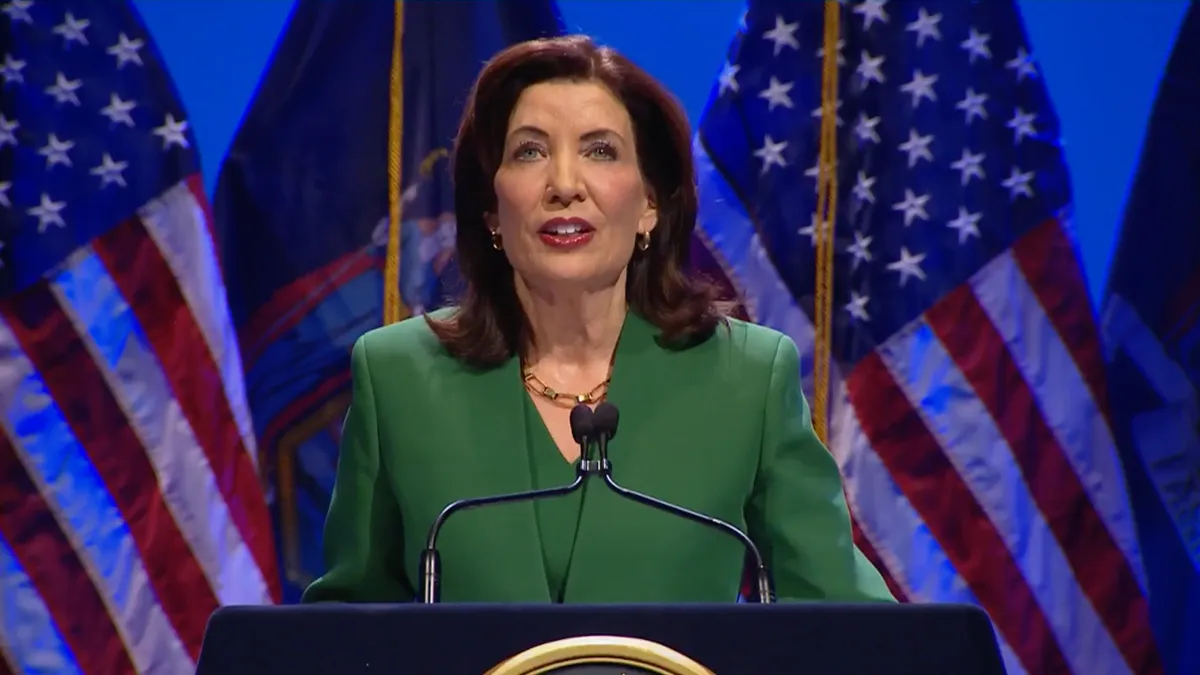

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York’s rules treat buy now, pay later purchases too much like credit card transactions.

-

Credit card cap amendment stokes opposition

Industry trade groups for financial institutions have united to rail against legislation that could cap credit card interest rates.

-

CFPB to yank ‘unlawful’ open banking rule

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

-

Fiserv reaffirms Clover revenue goal

The company’s chief financial officer contended the point-of-sale unit will still deliver $3.5 billion in revenue this year despite a recent volume growth slowdown.

-

Executive Shuffle: Fiserv, Temenos, Medius

Recent executive appointments demonstrate the importance software and financial services firms are placing on product strategy.

-

Clair, Alternative Payments raise capital

The two B2B payments industry startups each raised just over $20 million in the past month despite a “challenging” economic climate.

-

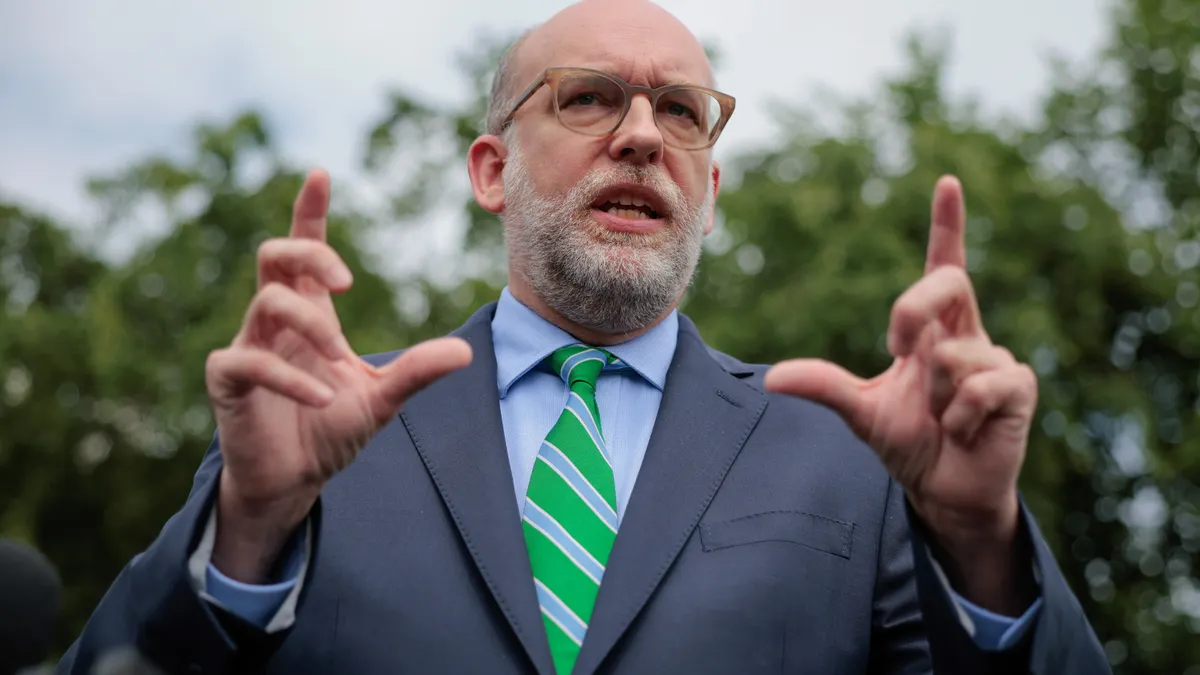

Durbin, Marshall push credit card amendment

Sens. Roger Marshall and Dick Durbin aim to add their Credit Card Competition Act legislation to the GENIUS stablecoin bill advancing in Congress.

-

Cash use declines as cards rise: Atlanta Fed

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

-

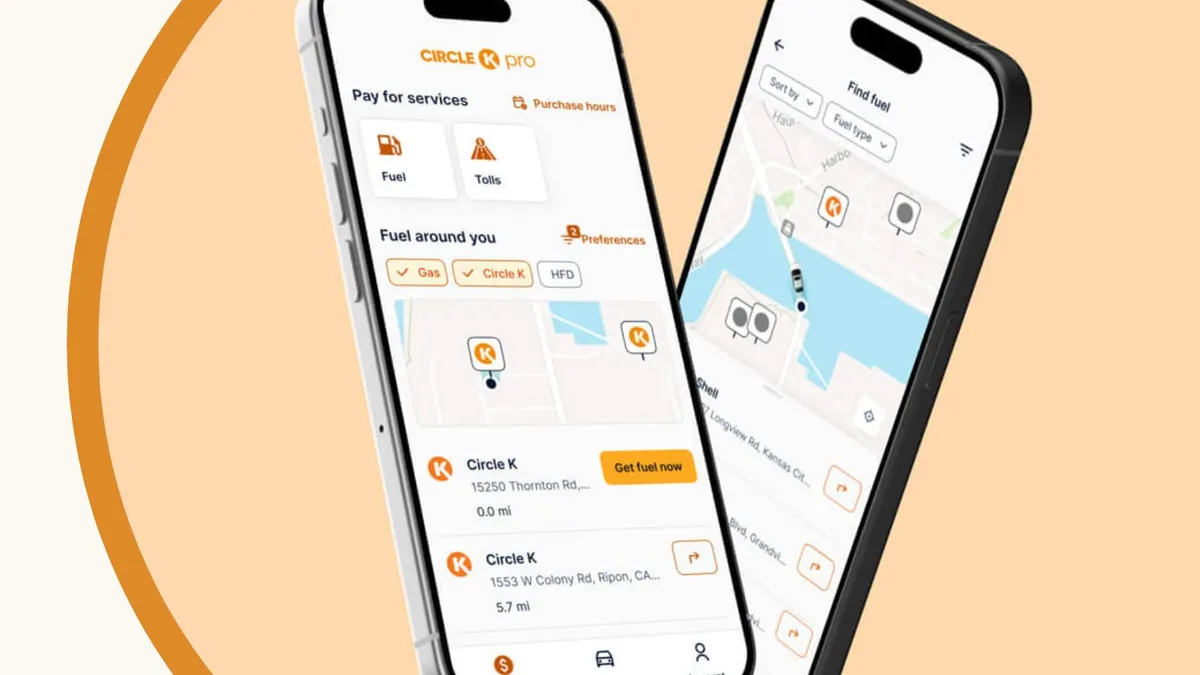

Retrieved from Circle K.

Retrieved from Circle K.

Circle K launches fleet payment mobile app

The program, developed alongside Car IQ, is designed to help drivers avoid credit card skimmers at the pump.

-

FIS quizzed on profit margins

The company’s chief financial officer was in the hot seat last week, explaining at an investor conference how he’ll bolster the bottom line.

-

Klarna touts merchant growth

The buy now, pay later provider surpassed 100 million users globally this year, but also reported widening consumer credit losses for the first quarter.

-

Visa, Mastercard $5.5B settlement advances

Plaintiffs in the card network litigation say problematic third-party communications regarding claims has declined since a February filing deadline.

-

Amex offers virtual card to small businesses

The company has long provided the service to corporate clients, but this month started letting small business owners pay suppliers who accept Amex without a physical card.

-

Q&A

Paymentus keeps the lights on

Utilities and auto loans may not be exciting, but nondiscretionary payments is a profitable business largely unaffected by downturns, CEO Dushyant Sharma says.

-

Why Mastercard invested in Corpay

The $300 million infusion in a cross-border partner creates a complementary tie, the network’s CFO said. It also comes as headwinds rise on that front.

-

Capital One closes Discover deal

Completion of the combination results in the richest banking deal of the past six years and creates the nation’s largest credit card issuer.

-

Hack could cost Coinbase up to $400M

The crypto exchange is offering a $20 million reward for information leading to the hackers’ arrest. Coinbase terminated customer support agents who leaked customer data.

-

CFPB slashes Wise penalty

The U.S. unit of fintech Wise must pay the bureau $45,000 and roughly $450,000 in redress to affected customers – a far cry from the $2.5 million penalty issued in January.

-

FTA to defend open banking in court

The Financial Technology Association will seek to protect a Consumer Financial Protection Bureau open banking rule after receiving a federal judge’s permission to intervene.

-

Toast targets entertainment venues

The digital processor signed a Dallas-based chain of driving ranges as a customer in the first quarter, and has made a push to add movie theaters, bowling alleys and arcades.